Bad Checks and Credit Card Chargebacks – How to Deal with Them - Webinar

Learn about bad checks and credit card chargebacks, when not to sign a bond or lien release, when to send a statutory demand latter, and when to file a lawsuit.

Last updated:

Nov

24

,

2025

Published:

Apr 01, 2022

14 Mins

Read

You should understand a few things about credit card chargebacks and bad checks, when to record a satisfaction of lien, when and when not sign a bond or lien release, when send written notice, how to get reimbursed your legal fees, why you should send a statutory demand letter, credit card chargebacks, when to file a lawsuit, what to do about credit card chargebacks, when to use a conditional release of lien, tips to keep in mind about credit card chargebacks and bad checks, and why you should always protect your lien rights and bond rights.

This blog is from a webinar that was presented by SunRay Construction Solutions and Alex Barthet. Alex is a board-certified construction attorney who serves clients in the state of Florida. In this blog we will discuss bad checks and credit card chargebacks.

Bad Checks

What you should understand about a check are the following points:

a. Check is a promise to be paid in the future

A check almost always feels like actual money, but it is just a promise to be paid in the future. If you get a check you have to deposit it in the bank. It has to clear and then you get the money, versus cash which if you get at the time of the transaction, you can use immediately.

b. Most common bad checks are designated as NSF, account not found, or stop payment

There are three primary types of bad checks that you will run into:

i. NSF

NSF is non-sufficient funds in the bank account. This means that the bank account is open but there is just not enough money for the check to clear.

ii. Account not found

Account not found means that the account was closed at the time that the check was presented for payment, so that account is no longer there.

iii. Stop payment

This is when the check is given to you and it is good at the time it is given, but at the time that you submit it for presentment. Or your bank submits it for presentment for payment, the maker of the check has put a stop payment. This means that he/she was instructed by their bank not to fund the check.

c. A check can be dishonored 30+ days after presentment

One of the things that you need to be aware of and that most people do not know, is that a check can be honored 30 days and sometimes longer than 30 days after presentment.

d. Funds availability does not mean check clearance

Just because your bank may make the funds available to you to draw upon, that is not the same as the check clearing. So, when you take a check to a bank, your bank may have a policy that says local checks will be made available within 48 hours and checks outside of the jurisdiction will be available in three or four days.

That is availability of funds and that does not mean that the check is going to come back as NSF or have a stop payment on the check. So be careful about how long it takes for you to truly know that a check is not going to be dishonored.

e. The penalty for passing a bad check can be both civil and criminal

If someone passes a bad check in most states, and in Florida especially, it is both a civil violation and a criminal violation meaning that people can go to jail. In Florida, if you pass a bad check of more than $150, that is a felony. So there are some serious ramifications for passing bad checks.

What Not to Do With a Check

Now we will talk about what you should not do.

a. Believe that holding a slip of paper is the same as having money

The first thing is you should not believe that holding a little slip of paper is the same thing as having money. If a contractor has given you a check, and let us say you are a supplier. You are asked to hold on it, but the contractor says he just needs a lien release now.

Remember that that piece of paper is no more than a promise to pay later, which can be dishonored. So, how much do you trust this person if they are telling you that the piece of paper they are giving you is really no good now? It means that you cannot deposit it now. But they want something from you of value which is a lien release.

b. Sign a bond or lien release if you are concerned if the check is good

Never sign a lien or bond release if you are concerned about the check not being good.

c. Record a satisfaction of lien before funds clear

You should never record a lien satisfaction before funds have cleared. this is seen a lot, when people put a construction lien on a piece of property and the other side says that you need to satisfy the lien. They also ask you to give them a recorded lien satisfaction in order for them to give you a check.

Sometimes they will send you a copy of the check that they have cut. Once you record that lien satisfaction, if they never give you the check or the check is no good, your construction lien is off the property. So our advice is to never actually record the lien satisfaction until you have the funds in hand.

We recommend having funds wired to you, and then once the funds hit, then you take the satisfaction to recording. But do not do it beforehand.

d. Do not accept post-dated checks

You should not accept post-dated checks. It is not that you cannot, but just know that if you accept a post-dated check, it cannot be criminally prosecuted. Because you have accepted the check knowing that at the moment you accepted it, those funds are not good. It is dated for a date in the future.

But there are reasons why accepting a post-dated check may make sense. Sometimes someone will get on a payment plan, and they will issue you four checks for $1,000 each to pay off the debt. These checks are post-dated, one this Friday, one next Friday, and so on.

If the checks clear there is no problem but holding those post-dated checks cannot be criminally prosecuted.

e. Agree to hold a check

You should not agree to hold a check because if you agree to hold a check, the other side cannot be criminally prosecuted. Again, this is because they are telling you when they give you the check that this check is no good when they are giving it to you. So you should try not to agree to hold checks for any period of time.

What to Do

Now we will talk about what you should do. When accepting a check, for criminal penalties to apply, meaning if you accept a check and it bounces, you must do the following in order to be able to pursue criminal penalties:

a. If accepting check in person, you need to obtain specific information and write on the check

If accepting a check in person, you need to obtain the following information from the presenter of the check and write it on the check itself: you need to write their full name, home address, phone number, place of employment, gender, date of birth, height, and their driver’s license number or state identification number.

If you have ever been to a check cashing store, you will notice that they do this routinely because their business is dealing with checks. They constantly run into bad checks so they follow this procedure to a T. If you do not do this, it is going to be very hard for a district attorney to prosecute your case for the bad check.

b. If accepting a check in the mail, the recipient must have a few specific pieces of information

If you accept a check in the mail, which is pretty common, in order for it to be given to the district attorney to prosecute criminally, and it is a bad check, you need to have an original contract, order, invoice, or some request for service in which the check intended to pay. That agreement needs to have the signature of the person that signed the check.

There are a lot of steps here. So, if you are a painter, a contractor hires you, and you have a contract with that company, the person that signs your contract also has to be the person that signs the check. This is very specific, but in order for the case to be prosecuted, the District Attorney will look for these things. It does not mean that they will not prosecute other cases, but they get a lot of bad check cases.

So, if you have not done their homework for them, it is unlikely that they are going to prosecute your case.

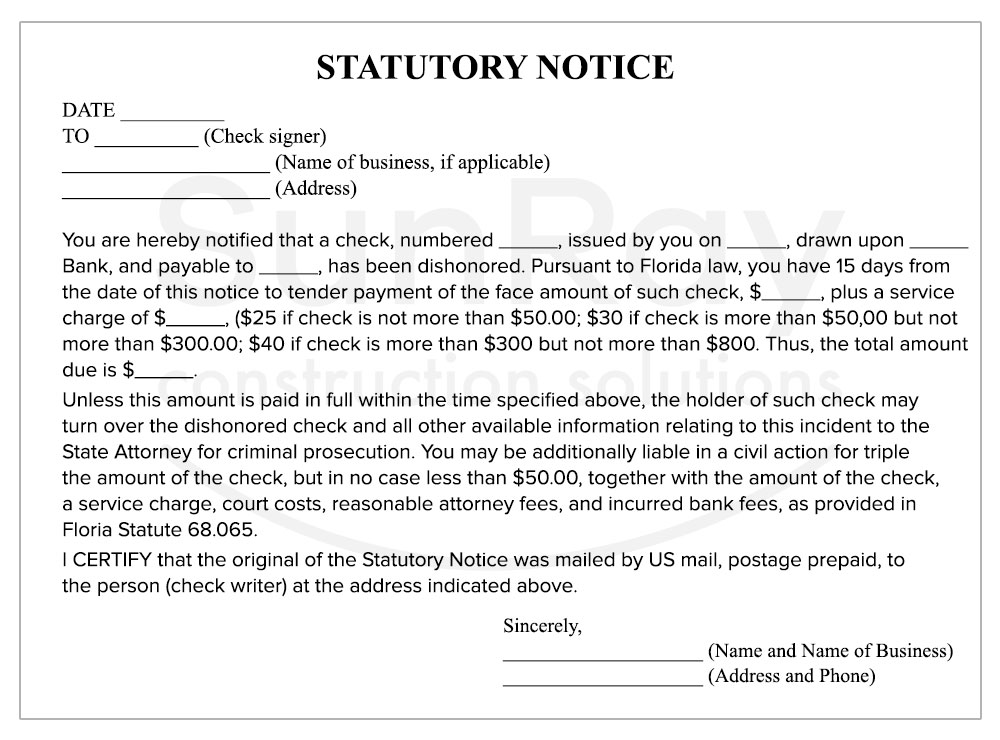

c. If the check is returned and marked by the bank then you must send a written notice

If the check is returned and marked by the bank as NSF or account closed, then you need to send a specific written notice. Now we talked about what you need to do with respect to the check itself. If you have a bad check, you have to send the following statutory notice that needs to be given and sent ideally via certified mail and U.S. mail.

In essence it tells the person who gave you the check that they have 15 days to make good on the check and they have to pay a small fee in addition to the amount of the check. Their failure to do so may render them liable criminally for this bad check. So, above is the form that you need for criminal prosecution.

d. After 15 days, if still not paid, report to the local State Attorney’s Office

After the expiration date of the 15 days and you are still not paid, then you can report the matter to your local State Attorney’s Office. There are State Attorney’s offices across the state.

e. Google [your city] and “State Attorneys Office

You should Google your city with the words “State Attorneys Office.” So what you would search for if you live in Orlando is “Orlando State Attorney’s Office, or if you are in Miami, then “Miami State Attorney’s Office.” It will take you to the appropriate State Attorney’s Office, where you should look for the bad check or worthless check division.

f. Find their ‘bad check’ or ‘worthless check’ division

All of the offices have a division dedicated to just bad checks. Then you should submit the information you have, which is a copy of the letter that you sent, proof that it was sent via certified, and a copy of the returned check ideally with the information that you have on it.

g. Most attorneys will not be interested in prosecuting bad check cases

Most State Attorneys are very busy unless the check is very large or it happens to be someone they are prosecuting because this person is routinely writing bad checks. You may find that the State Attorney is not very interested in prosecuting bad check cases. It does not mean that you cannot do it, or you should not, you should just want to temper your expectations about having a $2,000 bad check and thinking that the District Attorney is going to do anything about it.

h. For civil penalties to apply, you do not need that written on the check

In order for civil penalties to apply, what you need to do is have a check that is given to you, and it needs to either come back NSF, account not found, or a stop payment.

i. Civil penalties may also apply for stop payments

Stop payment does apply for civil remedies but the true penalty associated with the bad check which is getting up to three times the amount of the bad check, may not be available for a stop payment.

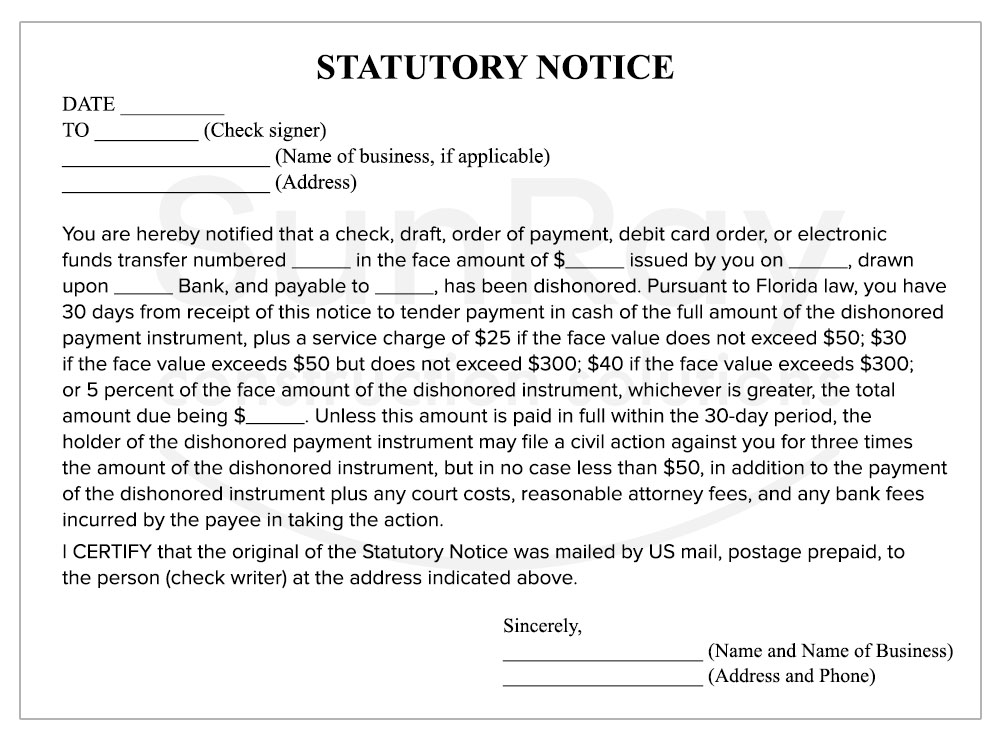

j. Send a statutory demand letter by regular and certified mail which may entitle you to damages and fees

You need to send a statutory demand letter via certified mail. If you send it and they do not make good on the bad check, then they may be liable to you for the amount of the bad check plus three times the amount of the bad check. So that is a total of four times the amount of the bad check, plus all your legal fees and costs.

Below is what the statutory notice looks like:

It is very similar to the criminal notice, but is not identical. So, what is recommended is that if you are going to do this, you actually have to send both notices. Do not try to combine the two. Send both notices, you can even send them in the same envelope. One is the civil remedy notice and the other is the criminal remedy notice.

k. After 30 days, if still not paid, file lawsuit plus treble damages plus legal fees and costs

After the expiration of the 30 days, if you are still not paid, you can file a lawsuit for the face amount of the bad check, plus 3 times the amount of the bad check, plus your legal fees and costs.

l. You may get a judgment against the company or person for a large amount

If someone gives you a bad check, and while these penalties sound really large, you may get a judgement against this company or this person for a very large amount. For example, if you are given a $10,000 bad check, you could get a judgment against the other side for over $40,000.

But if they could not pay the $10,000, how are they going to pay the $40,000? Keep that in mind for when you decide to pursue these claims. That being said, you will find some success where someone passes a bad check and you are able to get all of your money including all of the treble damages.

So, it is not that it is impossible, you should just temper your expectations about what you can get.

Credit Card Chargebacks

Now we will discuss credit card chargebacks.

Step 1: Consumer submits complaint with the issuing bank

Just like a check, just because you have a credit card that is processed, and the money goes into your account, does not mean that the money cannot go back out of our account. And that is really the problem with the chargeback.

The consumer or the business can submit a complaint in 60 to 120 days, so it is a long time after you have delivered goods or services.

Step 2: The issuing bank verifies whether the dispute is valid

What happens next is the issuing bank verifies whether the dispute is valid and if there is even enough information to satisfy the minimum requirements.

Step 3: If the bank finds the consumer at fault, the process ends here

If the bank finds that the consumer is at fault, the process ends right there. However, it almost never does.

Step 4: If not, consumer is refunded money and cardholder’s bank initiates chargeback process

For the consumer if it goes forward, the money is immediately refunded, and the card holder’s bank initiates the chargeback process against the merchant bank. So now the process starts where all of the money starts to come back out of your account.

Step 5: The merchant bank verifies the request and conducts their own investigation

The merchant bank verifies the request, starts their own investigation, and notifies you of the chargeback.

Next, one of two things can happen:

a. If chargeback is deemed invalid, processor will contact consumer’s bank and inform them

If the chargeback is deemed invalid by the merchant bank, the processor will contact the consumer’s bank and inform them of their findings. So, there are now two things that could happen for the consumer not to have the claim go forward:

- They did not fill in enough information therefore it ends right at the beginning. This is pretty rare, OR

- There is at least an initial investigation at which point the banks determine that it is not a valid chargeback and it stops there. It is also very rare for this to happen. It almost always goes to the next step.

b. If chargeback is deemed valid by merchant bank, merchant will be asked for documentation

If the chargeback is deemed valid, (valid does not mean they are right, it just means that there is just enough information for the chargeback to continue) the merchant will ask that you provide documentation on the chargeback.

c. If merchant provides proof, the chargeback will be stricken from the record, or vice-versa

If sufficient information is provided, the chargeback will be stricken from the record and the issuing bank will remove the funds from the cardholder’s account once again. If not, the chargeback stays, the funds are removed from your account, and additional fees are charged to the merchant. Typically, there is a penalty fee associated with having to conduct the chargeback process.

What to Do about Credit Card Chargebacks

What is seen most of the time when someone has to deal with the chargeback is that simple things were not done, which makes it very difficult for you as the merchant to win the chargeback process. So what should you do?

a. Obtain proper verification from your customer

You need to obtain proper verification from your customer, that they are who they say they are.

b. Make sure they sign their receipts and your business name is legible on their bill

Ideally, you want them to sign their receipts and the name of your business should be legible on their bill. That is a requirement actually for many merchants under your merchant service agreement.

c. Verify that the card is not expired

Then, you need to do some basic verification about the card, that it is not expired, and that the card holder is actually who he or she says they are. One way to minimize fraud or claims is to have the purchaser fill in the information themselves. So you should send them a link for them to fill in. There are other individuals who have a simple agreement that they have the consumer or buyer sign.

When you sell something to a consumer clearly disclosed as is, that will severely limit the ability for them to complain that something was wrong with the items. But again, if you are selling new things to another business on a credit card, you are typically not going to sell it as is. You will sell it with whatever warranty you have.

d. Adhere to current security standards, like chip readers

Make sure you follow all the security standards. If you are taking credit cards on the spot you need to make sure you have a chip reader.

e. Capture your customer’s signature digitally and compare to the one behind the card

If you are taking the card at the place of your business, verify that the signature is on the back of the card and that it matches.

f. Do not accept credit with no signature on the back

You should not accept a credit card at the place of your business if there is no signature on the back.

Now these are all the best practices. Most places do not follow any of these rules, and if you do not have a chargeback, it is not a problem. But if you do get a chargeback, then all of these things will get looked at. If you have not done them correctly, it could be a problem for you.

Protect Your Rights with a Notice to Owner

Sending a notice to owner is the first step to secure payment on construction projects. Learn how a notice to owner Florida helps protect your lien rights and ensures you get paid.

Tips to Keep in Mind about Credit Card Chargebacks and Bad Checks

Here are some things to keep in mind with respect to credit card chargebacks and bad checks.

a. When in doubt, get a wire transfer

If there is any doubt, you should get a wire transfer. A wire is an instantaneous transfer of fund, and typically, when the wire hits your account and you are notified of that wire, the money is good. It is cleared at the moment that you receive it and you do not have to worry about it coming back out of your account.

b. Always protect your lien and bond rights

Always remember to protect your construction lien and bond rights.

c. Never sign a bond or lien release if you are concerned

Never sign a bond or lien release if you are concerned. If you have a doubt like when you are given a check and you do not know that it is good, you can use a conditional release of lien, so that you are only releasing it to the extent that you actually get the money.

d. Never record a satisfaction of lien for a credit card payment before funds clear

Never record a satisfaction of lien for a credit card payment before the funds clear. For example, the credit card may be processed, you record your construction lien, and then they dispute the charge. If they do that, you cannot unwind your lien satisfaction.

e. Losing a credit card chargeback does not mean you cannot sue in civil court

The last thing to remember with respect to credit card chargebacks is that just because you lose a credit card chargeback procedure, does not mean that you cannot sue them in civil court. So, you sell them a piece of equipment, they charge back on the card, you lose that chargeback dispute, but you can still sue them in court and you can win.

So, the credit card chargeback is not the end of the process. There are other alternatives for you to pursue the claim.

Sunray Construction Solutions offers professional "Notice to Owner Florida" services to help you secure your mechanics lien florida rights in the construction industry. Looking for a free Notice to Owner form in Florida? Get your free, editable "Florida Notice to Owner Template" today for easy and accurate preparation.